Best business bank account in the Netherlands

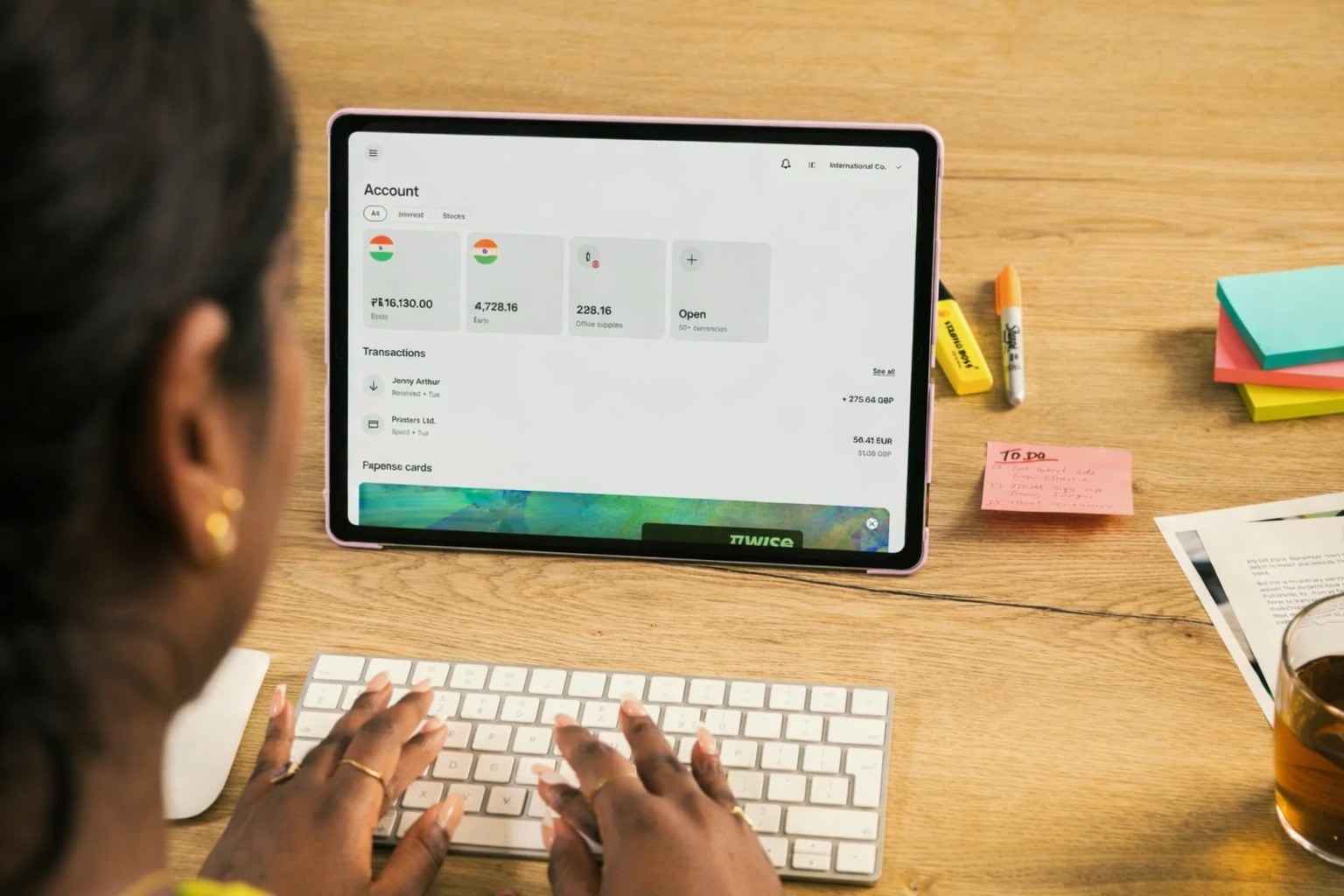

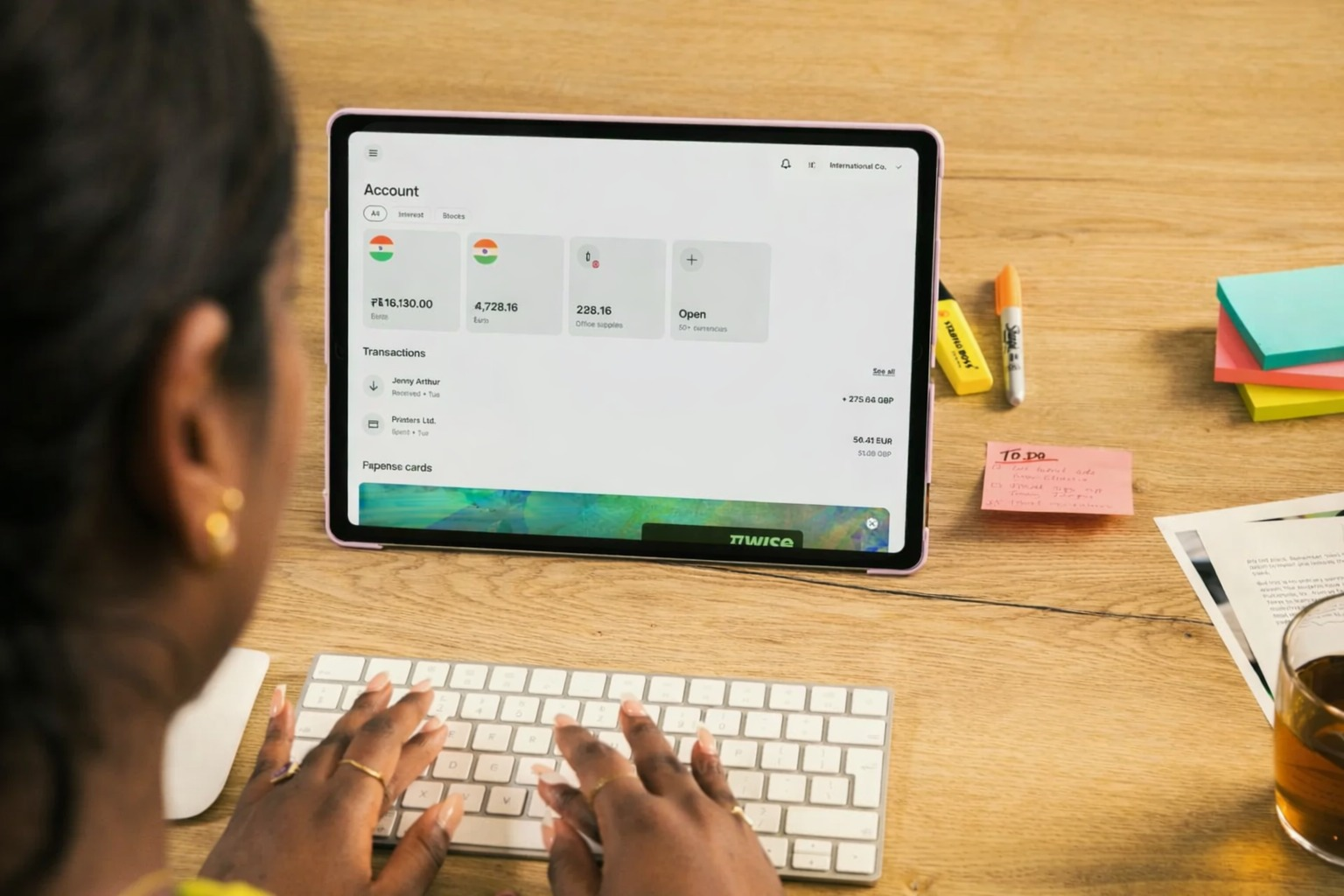

Opening a dedicated business bank account is an essential step when setting up a company in the Netherlands. It helps you manage company finances professionally, meet legal and tax requirements, and keep personal and business transactions clearly separated. This guide explains how business banking works in the Netherlands and compares some of the most suitable banks and financial providers for expats and non-residents. Alongside traditional Dutch banks, we also look at modern fintech options such as Wise, which can be useful for companies that operate across borders or deal with multiple currencies. Table of contents Can a foreigner open a business bank account in the Netherlands? Yes, foreigners can open a business bank account in the Netherlands, provided certain conditions are met. Eligibility depends on factors such as the legal structure of the business, whether the company is registered locally, and whether the applicant already holds a SEPA-IBAN. Most Dutch banks require businesses to be registered with the Kamer van Koophandel (KVK) before opening an account. For non-resident entrepreneurs, additional checks may apply. The Dutch Banking Association (NVB) offers a Quick Scan tool to help foreign founders assess whether they are likely to qualify for a Dutch business IBAN. Traditional banks such as ING, ABN AMRO, and Rabobank generally accept foreign-owned companies, although they may request extra documentation, proof of address, or references. Digital providers may be more flexible, especially for internationally active businesses. Insider tip:If your company already has a business account with a SEPA-IBAN in another EU country, you may not be legally required to open a separate Dutch account for euro payments. What is the KVK number and Quick Scan? A KVK number is issued when a company is registered with the Dutch Chamber of Commerce. Nearly all businesses operating in the Netherlands must register with the KVK before they can open a business bank account, pay taxes, or access financial services. For foreign entrepreneurs, banks may also request completion of the Dutch Business Bank Account Quick Scan, developed by the NVB. This tool helps banks determine whether an international business is eligible to apply for a Dutch IBAN. If your company is supported by the Netherlands Foreign Investment Agency (NFIA) or a recognised startup facilitator, the Quick Scan can be submitted to participating banks such as ING, ABN AMRO, or Rabobank. Banks usually respond within five working days. How to get a KVK number and use the Quick Scan Best business bank accounts in the Netherlands The best business account depends on your company’s size, structure, and international exposure. To provide a balanced overview, we compare established Dutch banks with modern fintech providers. Comparison criteria Overview comparison Provider Monthly fees Non-resident access Currency support Key features Wise Business No monthly fee Yes 40+ currencies Multi-currency IBANs, accounting integrations Finom €0–€249 Yes 17 currencies Invoicing, cashback, fast setup Revolut Business From €10 Yes 25+ currencies Expense controls, team cards ING Business From €9.90 Limited EUR Local banking, branch support ABN AMRO Business From €9.90 Limited EUR Tiered packages, bookkeeping tools Top 5 best business bank accounts in the Netherlands [2025] 1. Wise Business Account Best for: Companies managing international payments and multiple currencies Wise Business allows companies to hold and manage over 40 currencies, send international payments, and receive money with local account details in multiple countries. It is commonly used by freelancers, SMEs, and internationally operating businesses. 2. Finom Business Account Best for: Freelancers and small businesses seeking fast setup and invoicing Finom combines business banking with invoicing and expense management. Accounts can be opened fully online, often within minutes, and come with a Dutch IBAN. 3. Revolut Business Account Best for: Businesses needing flexible currency management Revolut Business offers multi-currency accounts, Dutch IBANs, and expense management tools. It suits companies that want app-based banking with scalable plans. 4. ING Business Current Account Best for: Entrepreneurs seeking traditional Dutch banking ING offers business accounts with online banking and optional in-branch support. New businesses may qualify for a free startup package for the first six months. 5. ABN AMRO Business Account Best for: Businesses wanting structured account packages ABN AMRO provides tiered business accounts with add-on services such as savings accounts and bookkeeping connections. Fees can be higher for non-residents. How to choose the right account for your business When selecting a business account, consider: The right choice depends on whether your business operates mainly within the Netherlands or across borders. How to open a business bank account in the Netherlands Step 1: Understand the requirements Most banks require KVK registration. Some also request a Dutch address. Step 2: Gather your documents Typically required: Step 3: Choose your provider Decide between a traditional bank or a fintech provider. Step 4: Submit your application Applications may be online or in person. Step 5: Verification and approval Approval can take days or weeks depending on complexity. Step 6: Start using your account Once approved, you receive your IBAN and access to online banking. Benefits of opening a separate business account A dedicated business account: Conclusion Business owners in the Netherlands can choose between traditional banks and digital providers, depending on their operational needs. Banks such as ING and ABN AMRO offer local presence and familiarity, while fintech solutions like Wise Business provide flexibility for companies working internationally. The best account is the one that matches your company structure, payment flows, and long-term plans.