Best GBP accounts in the Netherlands

Managing money in both pounds and euros is a common reality for expats living in the Netherlands. A GBP account can help you handle payments, transfers, and everyday spending more efficiently, without losing money to repeated exchange rate markups.

A GBP account is particularly useful if you receive income in pounds, support family in the UK, or want to hold GBP alongside euros for future use.

Both Dutch banks and international providers offer GBP account solutions, ranging from single-currency foreign accounts to multi-currency accounts with debit cards. Providers such as Wise allow you to hold GBP and exchange it alongside dozens of other currencies using transparent exchange rates. The best option depends on how you plan to use your account — whether for everyday spending, savings, or international transfers.

What is a GBP currency account?

A GBP currency account is a bank or online account that allows you to hold British pounds while living in the Netherlands. Instead of converting every incoming or outgoing payment into euros, you can keep funds in GBP and exchange them when it suits your needs.

Some GBP accounts support only pounds, while multi-currency accounts allow you to manage GBP, euros, and other major currencies within the same account.

Table of contents

- What is a GBP currency account?

- What can you do with a GBP account in the Netherlands?

- Types of GBP accounts

- Best GBP currency accounts in the Netherlands

- Wise account

- Revolut account

- ING Foreign Currency account

- ABN AMRO Foreign Currency Account

- Airwallex GBP Account

- Fees for GBP accounts in the Netherlands

- How to open a GBP account in the Netherlands

- How to use your GBP account in the Netherlands

- Conclusion

- Useful resources

What can you do with a GBP account in the Netherlands?

A GBP account gives you more control over how and when your money is converted. Instead of automatic conversions, you decide how to manage your balance, making both everyday life and international payments easier.

Common uses include:

- Receive payments from the UK

Get paid in pounds without automatic conversion to euros. Some providers offer UK account details so senders can make local transfers. - Hold pounds for future use

Keep GBP until exchange rates are more favorable, instead of converting immediately at bank rates. - Spend while travelling

Use a linked debit card to spend in the UK or elsewhere without additional foreign transaction fees. - Pay UK expenses from abroad

Cover bills, subscriptions, or other commitments directly from your GBP balance. - Move money between currencies easily

Multi-currency accounts allow you to switch between GBP, EUR, and other currencies when needed.

Types of GBP accounts

Multi-currency accounts

Multi-currency accounts allow you to hold GBP alongside other currencies in a single account. They often include features such as local account details, easy currency exchange, and debit cards.

- Wise: Hold and exchange 40+ currencies with local GBP and EUR account details.

- Revolut: Manage 30+ currencies in one app with a linked debit card.

- Airwallex: Global accounts with GBP details, primarily aimed at businesses.

Foreign currency accounts

Foreign currency accounts usually focus on a single currency, allowing you to hold GBP separately from your euro account and convert it when you choose.

- ABN AMRO: Personal foreign currency accounts for holding and managing GBP.

- ING: Foreign currency accounts mainly for business customers.

Some of these accounts also offer debit cards, depending on the provider.

Best GBP currency accounts in the Netherlands

You can open a GBP account in the Netherlands through a local bank or a specialist online provider. Dutch banks typically offer foreign currency accounts that allow you to hold pounds separately from euros, while online providers focus on flexibility, transparent pricing, and multi-currency features.

The best account depends on your priorities — whether you want to reduce conversion costs, manage multiple currencies easily, or receive international payments. Below are several commonly used options available to residents of the Netherlands.

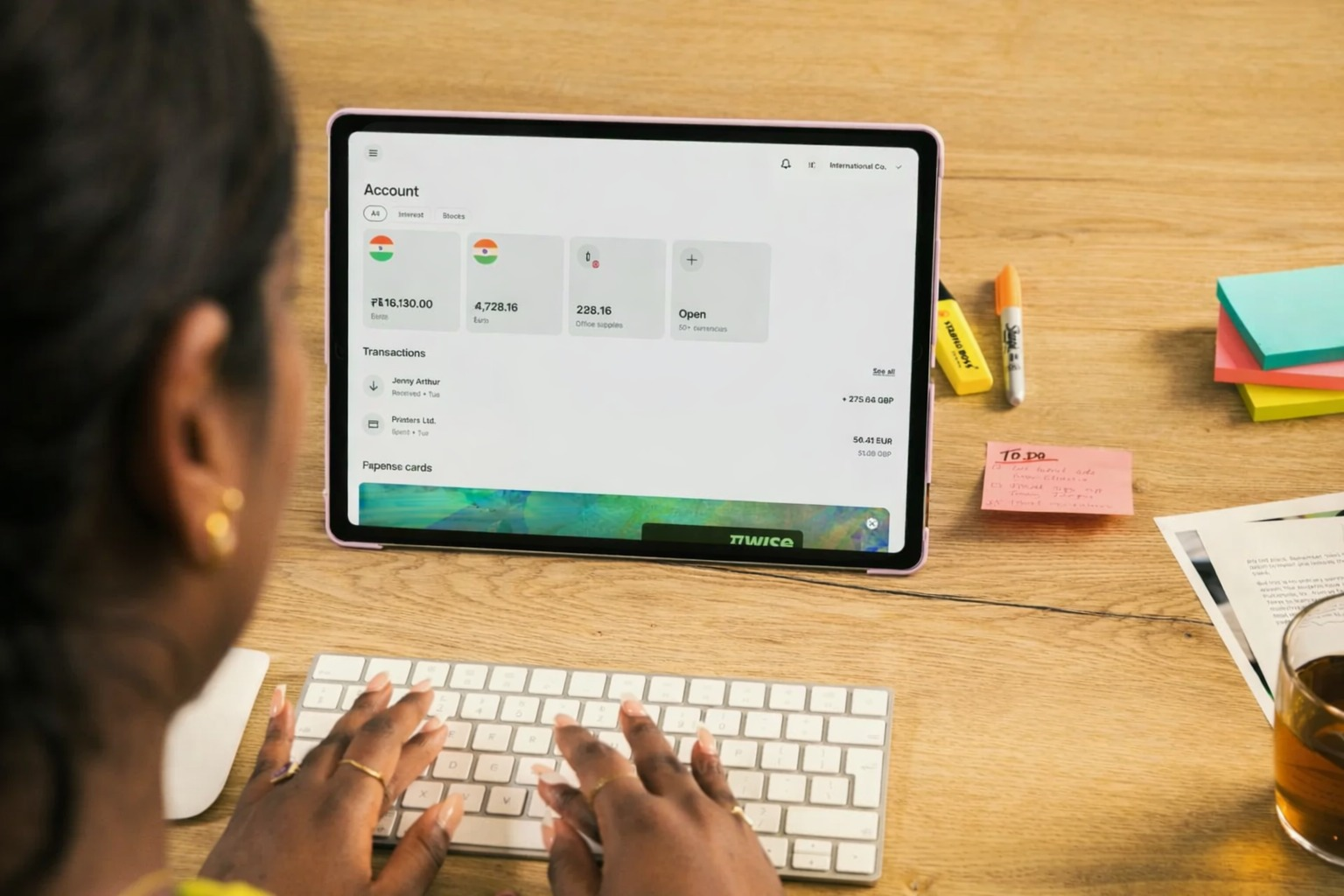

Wise account

A Wise account allows expats in the Netherlands to hold GBP alongside more than 40 other currencies in one place. Currency conversion uses the mid-market exchange rate with clear, upfront fees.

The account can be linked to a debit card for spending in over 150 countries or withdrawing cash directly from your balance.

- Hold and exchange GBP with 40+ currencies

- Receive GBP using local UK account details

- Spend or withdraw worldwide with a linked debit card

Account opening fee: None for personal accounts; business accounts pay a one-time setup fee

Eligibility criteria: Available to residents of the Netherlands and many other countries

Supported currencies: 40+ including GBP, EUR, and USD

Monthly fees: None

Exchange rates: Mid-market rate

Revolut account

Revolut offers multi-currency accounts that allow users to hold GBP alongside more than 30 other currencies. Accounts include a debit card and international transfer functionality.

Different subscription tiers are available, ranging from a free plan to paid plans with higher limits and additional features.

- Hold and exchange GBP, EUR, and other currencies

- Spend internationally with a linked debit card

- Send transfers to multiple countries

Account opening fee: None

Eligibility criteria: Residents of the Netherlands aged 18+

Supported currencies: 30+ including GBP and EUR

Monthly fees: Free plan available; paid plans have monthly fees

Exchange rates: Provider rates with limits depending on plan

ING Foreign Currency account

ING provides a Foreign Currency Account that allows business customers to hold and receive GBP without automatic conversion to euros. The account is linked to an existing ING business account.

- Receive and pay directly in GBP

- Choose from 25 supported currencies

- Manage balances via online and mobile banking

Account opening fee: None

Eligibility criteria: ING business customers in the Netherlands

Supported currencies: 25 including GBP and EUR

Monthly fees: €6 per month

Exchange rates: Markup applied when converting to EUR

ABN AMRO Foreign Currency Account

ABN AMRO offers a personal Foreign Currency Account for holding GBP and other supported currencies. Payments remain in the account’s currency until you decide to convert.

- Hold and receive GBP and other foreign currencies

- Avoid automatic currency conversion

- Conversion available on weekdays

Account opening fee: None

Eligibility criteria: Personal customers with an ABN AMRO current account

Supported currencies: 27 including GBP, EUR, and USD

Monthly fees: €5 per month

Exchange rates: Bank exchange rates with markup

Airwallex GBP Account

Airwallex provides global business accounts with local GBP account details, allowing businesses in the Netherlands to receive payments in pounds without unnecessary conversions.

- Local UK account details for GBP

- Hold and manage 20+ currencies

- Corporate cards available for international spending

Account opening fee: None

Eligibility criteria: Registered businesses in the Netherlands

Supported currencies: 20+ including GBP and EUR

Monthly fees: Free tier available; paid plans for higher usage

Exchange rates: Interbank rates

Fees for GBP accounts in the Netherlands

Costs vary depending on the provider and account type. Common fees include:

- Account opening fees (often free for personal accounts)

- Monthly maintenance fees (common with traditional banks)

- Currency conversion fees or markups

- ATM withdrawal fees

- Foreign transaction fees

- International transfer or SWIFT fees

Always review the fee schedule carefully before opening an account.

How to open a GBP account in the Netherlands

Opening a GBP account usually requires proof of identity, proof of address, and a BSN number.

With banks:

Dutch banks often require you to hold a euro account first and may request an in-branch appointment or additional documentation.

With online providers:

Digital providers allow you to apply and verify your identity fully online, often completing the process within minutes.

How to use your GBP account in the Netherlands

A GBP account can simplify daily financial management:

- Receive GBP payments from the UK

- Send international transfers without forced conversion

- Hold and exchange currencies when it suits you

- Spend abroad using a linked debit card

- Withdraw cash locally or internationally

- Manage business income and expenses in pounds

Conclusion

Managing pounds from the Netherlands looks different depending on your financial needs. Some people prefer traditional banks such as ING or ABN AMRO, while others value the flexibility and transparency offered by digital providers like Wise or Revolut.

The right choice depends on how you earn, spend, and save your money — whether that means holding GBP long-term, sending regular payments, or managing multiple currencies as part of an international lifestyle.