Banking in the Netherlands: the best Dutch banks for expats in 2025

Understanding how banking works in the Netherlands is an important first step for anyone relocating to the country. From opening a local account to learning how everyday payments work, having the right information early on can make settling in much easier.

For many expats, opening a Dutch bank account is one of the first practical tasks after arrival. Knowing which currency is used, how accessible cash machines are, and what services local banks provide helps reduce uncertainty and allows you to manage your finances with confidence.

This guide offers a complete overview of the Dutch banking system and covers the following topics:

- The banking system in the Netherlands

- Currency in the Netherlands

- Cash machines and ATMs in the Netherlands

- Banks in the Netherlands

- Banking services in the Netherlands

- Opening a bank account in the Netherlands

- Payment methods in the Netherlands

- Banking fees in the Netherlands

- Offshore banking in the Netherlands

- Ethical banking in the Netherlands

- Banking security and fraud in the Netherlands

- Lost or stolen bank cards in the Netherlands

- Making a complaint about banks in the Netherlands

- Useful resources

The banking system in the Netherlands

The Netherlands has a well-established and stable banking system made up of both national and international institutions. Oversight is provided by De Nederlandsche Bank, which acts as the country’s central bank, alongside the Authority for the Financial Markets (AFM).

Banking assets in the Netherlands are significant relative to the size of the economy, reflecting the country’s strong financial sector. At the same time, the number of physical bank branches has steadily declined as online and mobile banking have become the norm. Most residents now manage their finances digitally, and many retailers prefer electronic payments over cash.

Currency in the Netherlands

The Netherlands is part of the Eurozone and uses the euro (€) as its official currency. Banknotes in circulation include €5, €10, €20, €50, €100, €200, and €500, although many shops do not accept notes above €50. Coins range from 5 cents to €2.

Exchange rates fluctuate regularly, and expats who receive income or savings in other currencies should keep an eye on current rates when converting money.

Cash machines and ATMs in the Netherlands

ATMs are widely available across cities and towns, although their numbers have decreased as cash usage has declined. Some ATMs may be unavailable overnight, particularly in quieter areas.

Most international debit cards work without issue, provided they support common networks and use a four-digit PIN. Fees may apply when using ATMs outside your bank’s network, so it is worth checking your bank’s terms before withdrawing cash.

Banks in the Netherlands

There are several types of banks in the Netherlands, each serving different needs. Choosing the right one depends on how you plan to use your account and whether you value branch access, digital tools, or ethical banking principles.

Retail banks

Retail banks handle everyday personal banking, such as current accounts, savings, and debit cards. They usually offer online banking alongside physical branches with set opening hours.

Digital and mobile banks

Digital banking is widely adopted in the Netherlands. These banks operate primarily online and through mobile apps, offering fast setup and strong security without physical branches.

Common examples include:

- bunq

- N26

- Revolut

- Wise

Private banks

Private banks focus on high-net-worth individuals and offer personalised wealth management, investment advice, and financial planning through dedicated relationship managers.

Investment banks

Investment banks primarily serve corporations and governments, handling large-scale financial transactions and advisory services. Private individuals typically only access these services at very high wealth levels.

Corporate and commercial banks

These banks provide financial services for businesses, including loans, trade finance, and commercial real estate. Meetings are usually appointment-based rather than walk-in.

Popular banks in the Netherlands include:

- ABN AMRO

- ASN Bank

- ING

- Rabobank

- SNS Bank

- Triodos Bank

Banking services in the Netherlands

Dutch banks offer a broad range of financial services. Availability and conditions vary by provider.

Current accounts

A current account (betaalrekening) is the standard personal account used for daily transactions. It usually includes a debit card, online banking, direct debits, standing orders, and access to savings accounts.

Overdrafts

Some banks allow overdrafts, but interest rates are generally high. Limits and availability depend on your financial profile.

Loans

Personal loans may be secured or unsecured and offered at fixed or variable rates. Eligibility depends on income, residency status, and credit history.

Mortgages

Mortgage products in the Netherlands include linear and annuity mortgages. Expats often work with specialist brokers who understand international income and residency situations.

Investments

With low savings interest rates, many residents invest through banks or online brokers. Options include shares, funds, bonds, and other financial instruments.

Insurance

Health insurance is mandatory in the Netherlands, while other types—such as home, liability, or professional insurance—depend on personal circumstances.

Opening a bank account in the Netherlands

Although not legally required, a Dutch bank account is often essential for renting property, receiving a salary, or arranging utilities.

Typically required documents include:

- Valid ID (and residence permit if applicable)

- Citizen Service Number (BSN)

- Proof of address

Payment methods in the Netherlands

The Netherlands is highly cash-light, with electronic payments dominating everyday transactions.

Cash

Cash is still accepted but less common, and some shops do not accept it at all.

Checks

Checks are rarely used and generally not accepted for everyday payments.

Debit and credit cards

Debit cards are the primary payment method. Credit cards are accepted less widely but are useful for online purchases and travel.

Direct debits and standing orders

These are widely used for recurring payments such as rent, utilities, and insurance.

Online and mobile payments

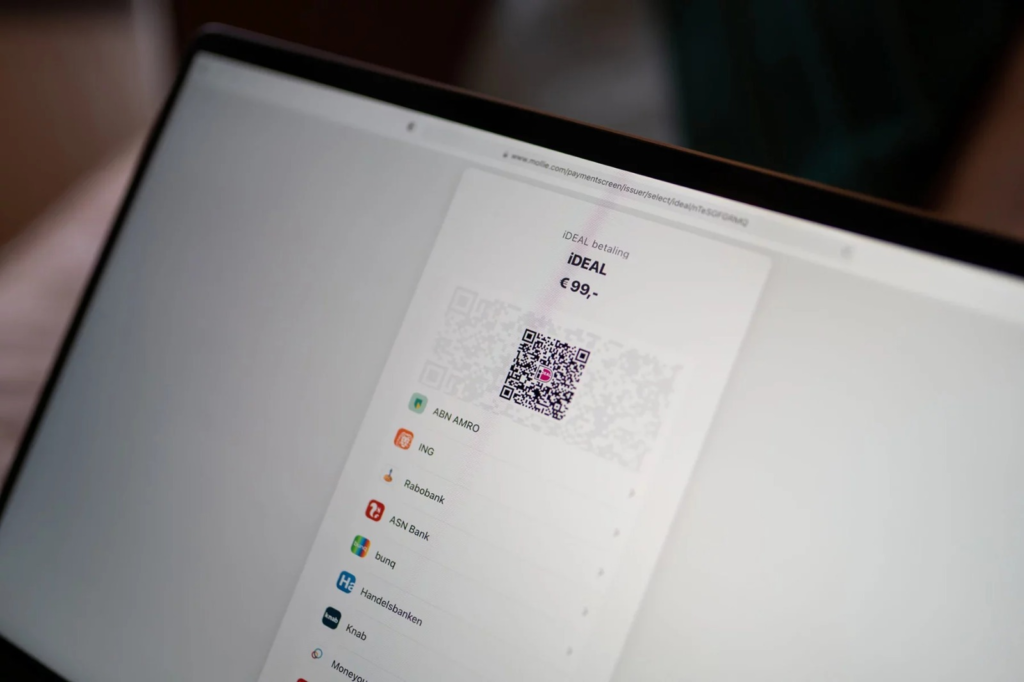

Online banking and mobile payments are extremely common. The local payment system iDEAL dominates e-commerce, and payment-request apps are widely used.

Local and international money transfers

Most transfers are made online. SEPA transfers within Europe are usually low-cost, while international transfers may involve higher fees.

Banking fees in the Netherlands

Banks typically charge monthly account fees and additional costs for services such as cash withdrawals, extra cards, or international transfers. Digital banks often offer lower-fee structures, which appeals to many expats.

Offshore banking in the Netherlands

Some expats choose offshore banking for international income management. Dutch offshore institutions provide deposit protection up to €100,000 under EU rules.

Ethical banking in the Netherlands

Ethical banking is well-established in the Netherlands. Institutions such as ASN Bank and Triodos Bank focus on sustainability, social responsibility, and environmentally conscious investments.

Banking security and fraud in the Netherlands

Dutch banks use modern security measures, but phishing and impersonation scams do occur. Customers are advised to verify all communications and never share security codes.

Lost or stolen bank cards in the Netherlands

Lost or stolen cards should be blocked immediately by contacting your bank. Replacement cards are usually issued within a few working days.

Making a complaint about banks in the Netherlands

Complaints can be raised directly with your bank. If unresolved, cases can be escalated to the Kifid, which handles disputes related to financial services.

Useful resources

- De Nederlandsche Bank

- Dutch Banking Association

- Dutch Payments Association